Has your Home Loan EMI Decreased or Increased? RBI Announces Decision on Repo Rate

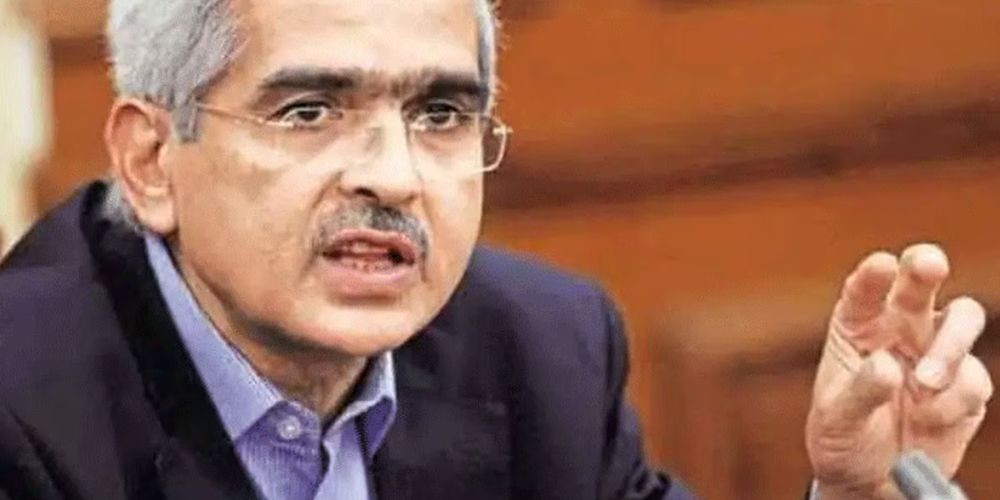

Reserve Bank of India (RBI) Governor Shaktikanta Das has issued a monetary policy review. He has not made any changes to the key policy rate, the repo rate, this time as well.

Reserve Bank of India (RBI) Governor Shaktikanta Das has issued a monetary policy review. He has not made any changes to the key policy rate, the repo rate, this time as well. The repo rate has been kept unchanged at 6.5 percent this time as well. Maintaining the repo rate at the previous level will benefit loan applicants. This is the sixth occasion when there has been no change in the repo rate. Das revealed that during the MPC meeting, a decision was made not to make any changes to the repo rate. The central bank last increased the repo rate in February 2023.

Announcing the monetary policy review, RBI Governor Das said that amidst global uncertainty, the country’s economy is showing strength. On one hand, economic growth is increasing, while on the other hand, inflation has decreased. To keep inflation under control and boost economic growth, the repo rate has been maintained. He said that the pace of growth is increasing and is surpassing the estimates of most analysts.

What is Repo Rate? The rate at which banks are lent money by the RBI is called the repo rate. An increase in the repo rate means that banks will get loans from RBI at a higher rate. This will lead to an increase in the interest rates of home loans, car loans, personal loans, etc., directly affecting your EMIs.